Why Your Company Needs to Perform Credit Analysis?

Credit analysis is essential for companies that sell on credit.

Introduction

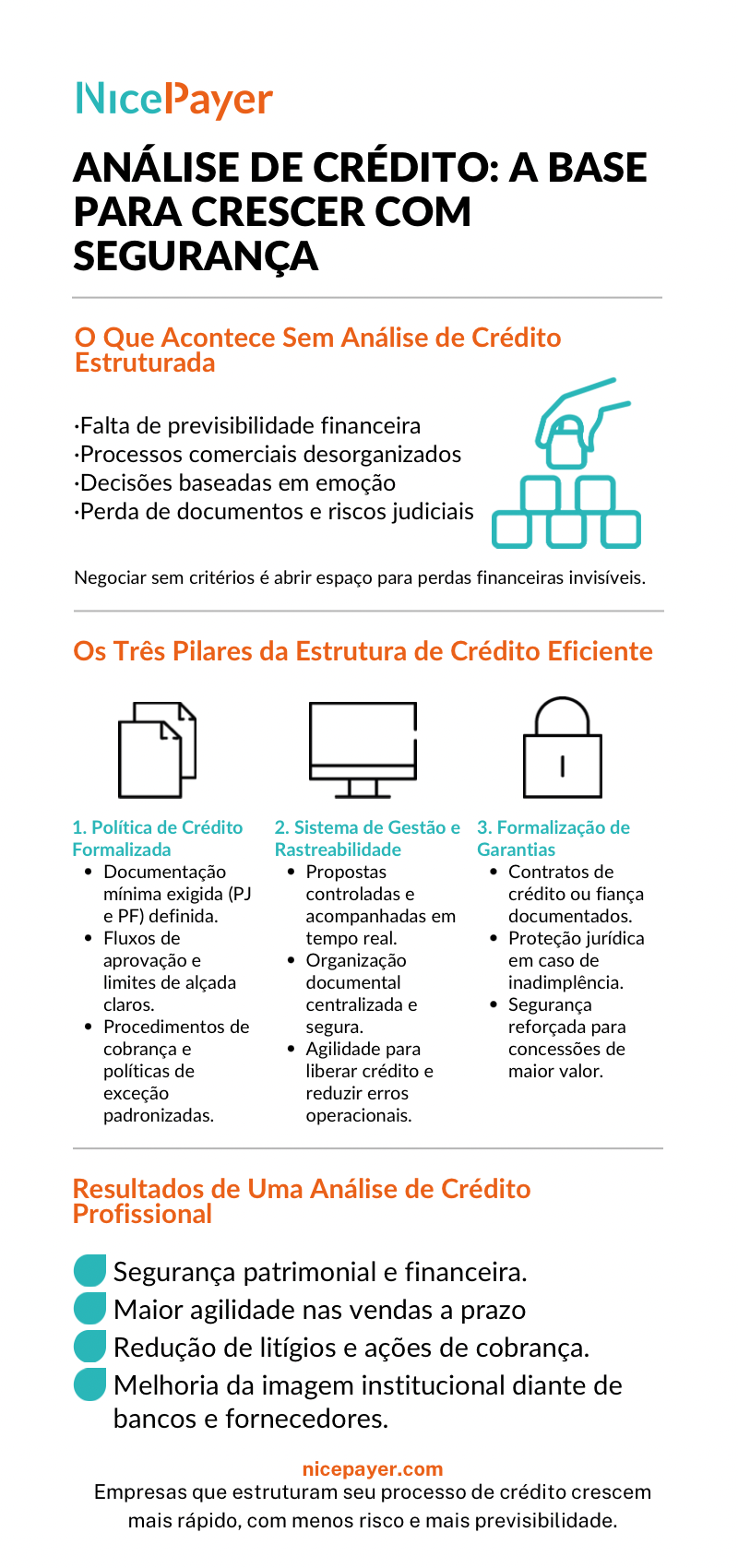

Structuring a credit analysis process is essential for the financial security of companies that sell on credit. The lack of a clear procedure increases the risk of default, hinders growth, and compromises cash flow.

Here we present the key points to understand why your company needs to professionalize credit analysis.

The Foundation: A Clear and Formalized Credit Policy

Every company that grants credit must have a credit policy that is clear, formalized, and approved by management.

This document is the basis for the security of the entire commercial and financial operation, defining:

- Minimum documentation required for individuals and companies;

- Collection procedures and deadlines for recovery actions;

- Rules for exceptional credit grants during seasonal periods;

- Approval flows, authority limits, and responsibilities of each area involved.

A well-written policy prevents subjective decisions, organizes operations, and legally protects the company.

Structuring the Credit Policy Does Not Restrict Sales: It Strengthens Them

The credit department does not exist to block sales but to leverage business safely.

With clear rules, the sales team knows exactly the limits, terms, and credit conditions, avoiding unsafe or risky negotiations.

Companies that structure their credit approval process ensure:

- Agility in customer service;

- Fewer internal conflicts;

- Faster and safer approval processes.

Formalization brings predictability and strengthens commercial operations.

Credit Management System: The Workflow That Organizes and Protects

Having a credit management system is essential to ensure that the entire operation is traceable and secure.

Without a system, credit proposals circulate by email, documents get lost, and the approval flow becomes confusing, generating:

- Delays in credit release;

- Loss of critical documents;

- Conflicts between sales and credit departments;

- Difficulty in locating evidence in case of lawsuits.

An efficient system organizes documents, separates customer portfolios, respects approval authorities, and ensures information security.

Infographic

Formalization of Guarantees: Real Protection Against Default

The formalization of guarantees is a strategic differential in the credit granting process.

Trust is not enough: it is necessary to formalize payment commitments through credit contracts or guarantee agreements.

The requirement for guarantees must be evaluated case by case, with clear criteria in the credit policy, but never ignored.

The financial market does not grant credit without guarantees; companies should not give up this protection either.

- Companies that adopt the formalization of guarantees:

- Drastically reduce the risk of default;

- Strengthen their position in possible legal collections;

- Gain more bargaining power with financial institutions.

The Credit Culture: Starting Right is Essential

Companies that structure credit management from the beginning create a culture of security and professionalism.

The formation of a healthy customer portfolio begins with thorough analysis, complete documentation, and formalized guarantees.

This culture:

- Reduces risks from the first sale;

- Ensures that new salespeople understand and respect the process;

- Increases the company's credibility with suppliers, banks, and investors.

Well-done Credit Analysis: Real Cases Show the Difference

Companies that structure their credit process make smarter decisions.

There are cases where the company is new, but the partner has sufficient assets to guarantee the operation — and with technical analysis, credit is safely granted.

On the other hand, there are old and well-known clients, but without consistent assets, who present high risks and must be carefully evaluated.

The analyst’s experience and the application of the credit policy are decisive at these moments.

Conclusion

Analyzing credit professionally means protecting cash flow, strengthening sales, and building solid growth.

Well-defined credit policy, efficient management system and the formalization of guarantees are the three essential pillars to transform granted credit into a competitive advantage.

Companies that professionalize their credit process sell more, lose less, and grow safely in the market.