What Is Business Credit Analysis and How Does It Work

A well-structured credit analysis process is essential.

Introduction

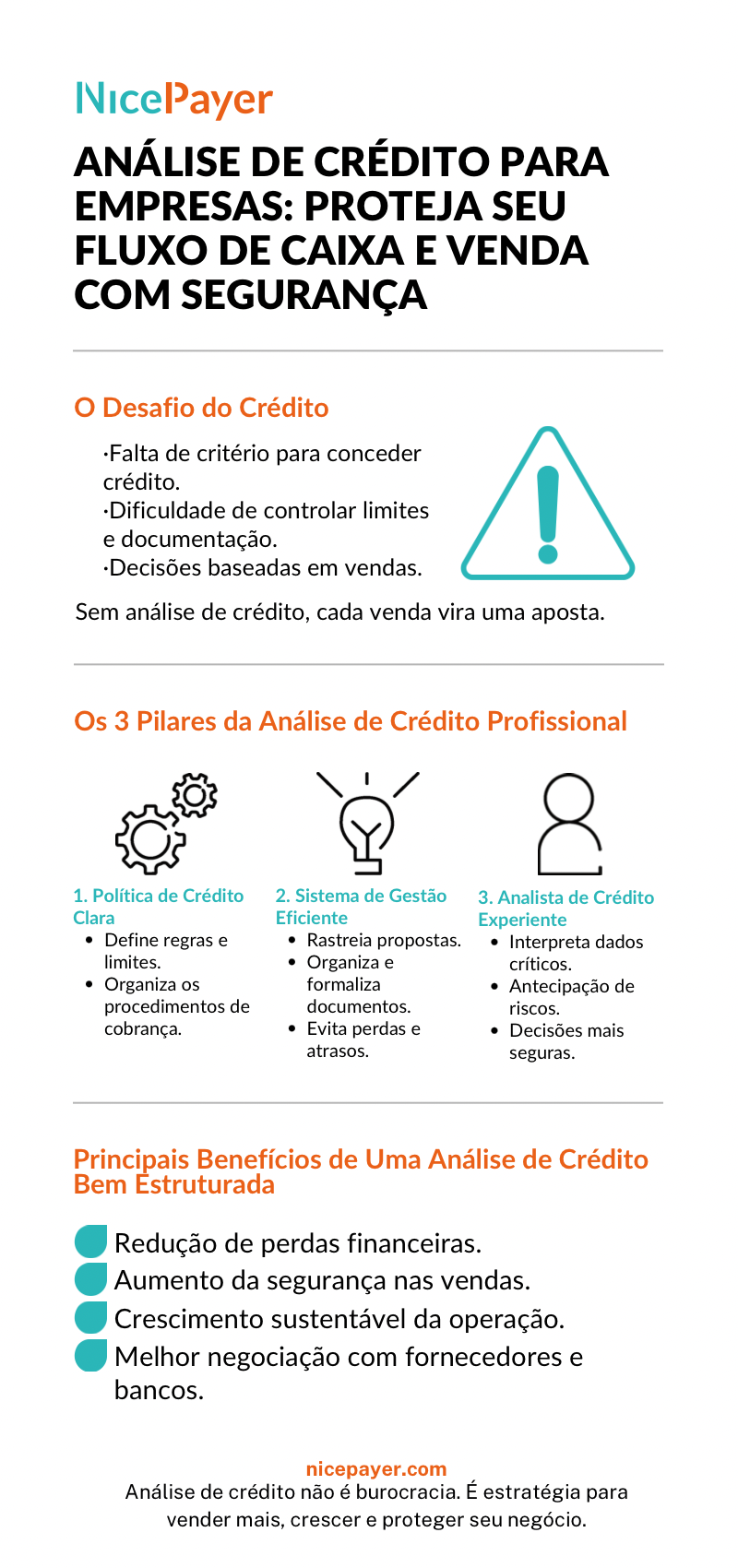

Payment default is one of the main factors that compromise the cash flow of companies that sell on credit. A well-structured credit analysis process is essential to protect capital, ensure business continuity, and strengthen sales.

Here we present in a practical way what business credit analysis is, its fundamental pillars, and the main challenges.

What Is Business Credit Analysis?

Business credit analysis is the process of evaluating the payment capacity of corporate clients. The decision is based on financial data, historical behavior, registration status, and market risk. The goal is to grant credit safely, protecting operations while maintaining commercial agility.

The Importance of Credit Analysis

Without credit analysis, every sale represents a high risk.

Delinquency directly impacts cash flow, reduces reinvestment capacity, and can jeopardize the entire operation. Companies that establish a solid and technical process are able to:

- Reduce financial losses;

- Increase sales security;

- Improve negotiation conditions with clients and suppliers;

- Grow sustainably.

Credit analysis is not a barrier. It is a tool for selling with security and predictability.

Fundamental Pillars of Credit Analysis

The credit policy defines rules, limits, and collection procedures.

Without clear guidelines, credit decisions become subjective, increasing the risk of loss.

2 - Efficient Management System

Automating the proposal workflow allows credit requests to be tracked, documented, and approved quickly and securely.

The system prevents information loss, eliminates delays, and improves communication between departments.

3 - Experienced Credit Analyst

A trained credit analyst is the final safeguard of the process.

With technical knowledge and strategic vision, the analyst can anticipate risks, interpret critical information, and make assertive decisions to protect the company and support commercial growth.

Without proper structure, credit analysis faces issues such as:

- Alto custo de operação interna;

- Loss of documents and lack of traceability;

- Credit approvals based on emotion rather than data.

Essas falhas prejudicam tanto a área financeira quanto a área comercial, gerando conflitos, atrasos e retração no crescimento.

Conclusion

A business credit analysis is one of the pillars of financial sustainability in the B2B market.

Companies that professionalize this process are able to sell more, reduce risks, and accelerate their growth in a solid way.

Structuring the credit policy, implementing an efficient management system, and relying on an experienced analyst are strategic steps to turn credit into a real competitive advantage.