Outsourcing credit analysis: when and why?

Understand when outsourcing is recommended and what advantages it offers.

Introduction

After understanding what credit analysis is, knowing the required documents, avoiding the most common mistakes, and calculating the real cost of setting up an internal department, the question arises:

Does it make sense to keep everything in-house? Or is it time to consider outsourcing?

In this article, we show when outsourcing is recommended, what advantages it offers, and why so many companies are choosing this lighter, safer, and more efficient path.

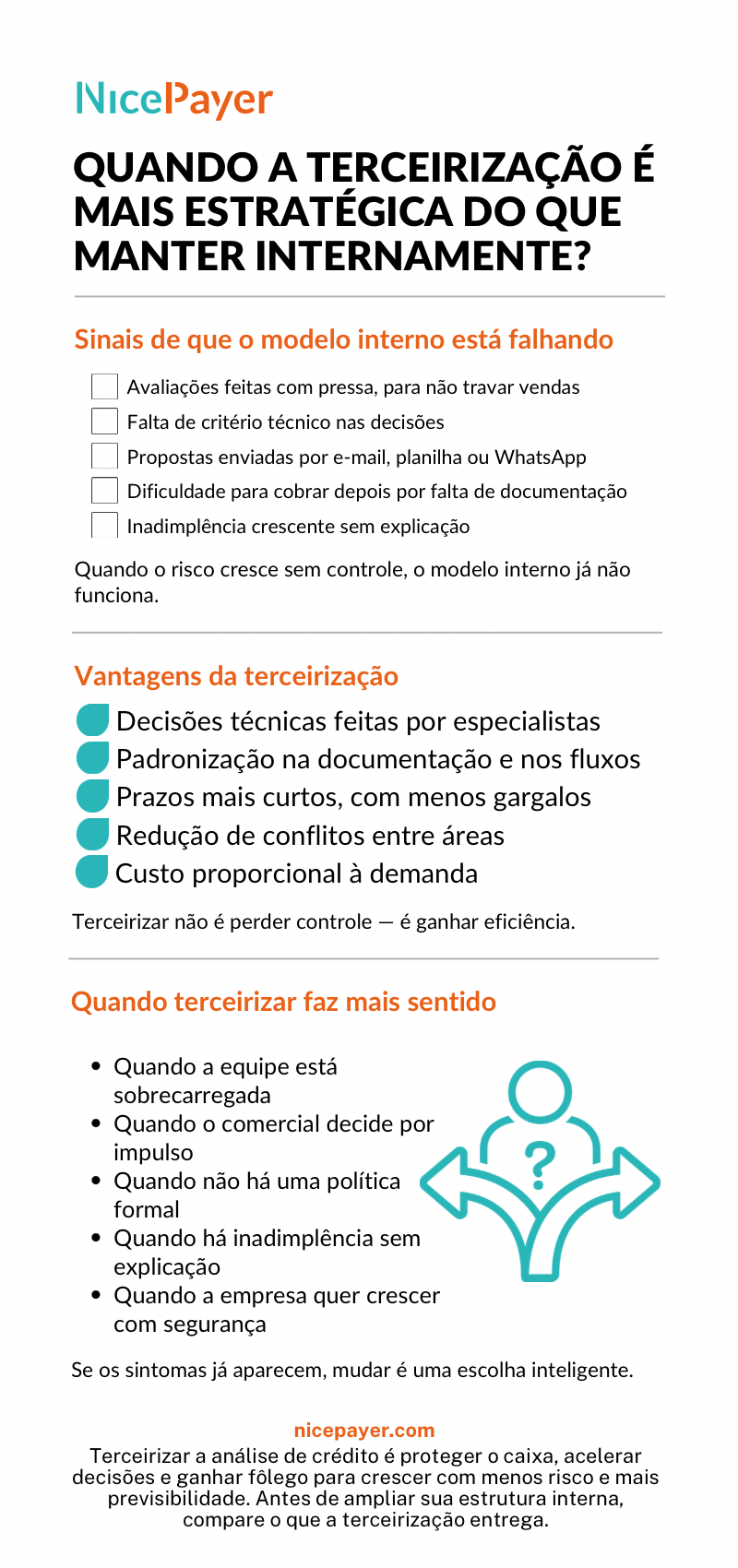

When internal credit analysis starts to fail

Even in organized companies, internally performed credit analysis often faces problems such as:

- Lack of time for the team to thoroughly evaluate each client

- Sales making impulsive decisions to avoid losing a sale

- Documents sent by email, WhatsApp, or spreadsheets without control

- Delays in responses due to overload or lack of technical staff

- Conflict between the 'urgent' sales need and the 'necessary' analysis

- Delinquency growing without an apparent cause

If these signs have already appeared in your operation, it is a clear indication that the current model is exhausted—and that the credit process needs to be professionalized in a more structured way.

Why outsourcing may be the right solution

Outsourcing credit analysis is not giving up control—it is ensuring that it happens with consistency, method, and strategic vision.

By outsourcing, the company gains:

- Expertise: the process is carried out by those who do it every day

- Speed: short deadlines, fast responses, no email queues

- Impartiality: decisions based on data, not commercial ties

- Standardized documentation: everything traceable, validated, and archived

- Cost savings: no need to build a team, hire a system, or maintain internal structure

In many cases, sales want to sell, finance needs to keep cash flow healthy, and credit analysis ends up without a defined technical criterion. When this happens, the risk does not appear immediately—but grows silently, month after month.

Outsourcing solves this problem with method, impartiality, and specialized vision.

Infographic:

Comparing with the internal structure

In our article “How much does it cost to maintain an internal credit department?” we showed that keeping a complete process in-house requires:

- Qualified technical analyst (R$ 8,000/month)

- Robust system (R$ 3,400 to R$ 4,800/month)

- Continuous support, training, and updates

- Credit policy (R$ 8,000 to R$ 20,000 – one-time cost)

- Rework and operational delays (estimated R$ 1,000/month)

Estimated total monthly cost: R$ 12,400 to R$ 13,800

Initial cost (setup + policy): up to R$ 70,000

By outsourcing, the company can obtain all of this at a cost equal to or lower than keeping a single internal analyst—without charges, absences, or the need to coordinate the process.

When does outsourcing make more sense?

- When the volume of proposals is increasing

- When there is delinquency without a clear cause

- When sales are deciding credit out of urgency

- When there is no formalized policy

- When management wants more predictability and security

In any of these scenarios, outsourcing means taking control of credit with more focus, less risk, and greater agility.

Conclusion

Outsourcing credit analysis is not an expense—it is protection.

It protects cash flow, protects sales, and protects operational health.

Companies that choose this path gain in efficiency, security, and above all, freedom to grow with confidence.

Before hiring more staff, signing an expensive system, or trying to fix what no longer works, it is worth comparing what outsourcing offers.

Do you want to understand how outsourcing works in practice?

Talk to a specialist and see if this is the right solution for your business.