Most Common Mistakes in Credit Analysis

Check the most common mistakes made by companies.

Introduction

The business credit analysis is a strategic tool, but many companies still handle this process in an improvised way.

The result is weak decisions, increased default, and direct impacts on cash flow.

In this article, we present the most common mistakes companies make in granting credit and how to avoid them with structure, method, and responsibility.

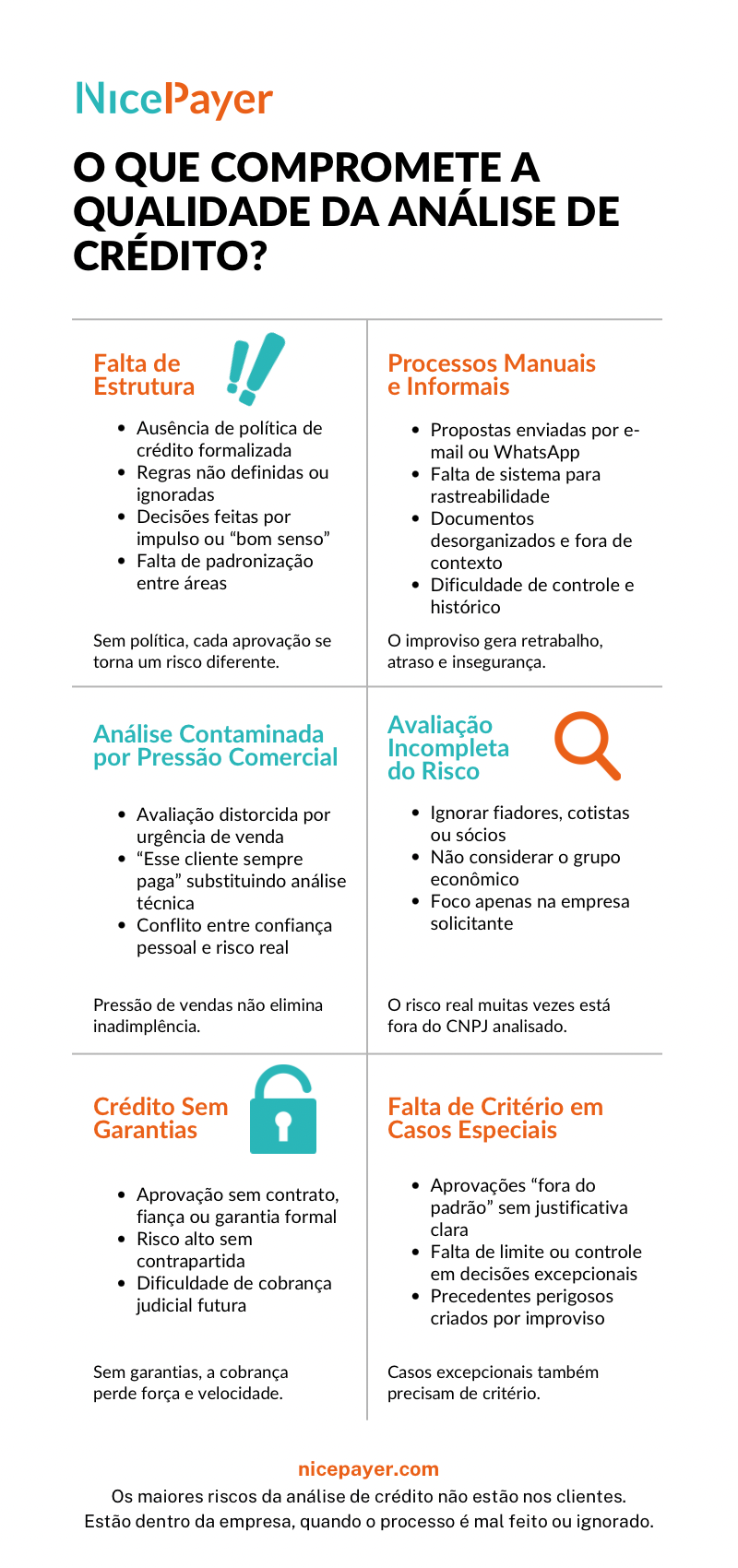

Lack of a Formalized Credit Policy

One of the most frequent mistakes is not having a credit policy that is clear, written, and approved by management.

Without this, decisions become subjective, based on intuition or circumstantial pressure.

The credit policy defines:

- The mandatory documentation by client type;

- The approval flow (who analyzes, who decides);

- The criteria for exceptions and approval limits.

Without these guidelines, the company is vulnerable to contradictory decisions and operational losses.

Manual and Decentralized Process

Conducting the analysis process via email, spreadsheets, or isolated messages is a serious operational mistake.

Without an integrated system, information is lost, documents become fragmented, and operational control is weakened.

This type of flow generates:

- Frequent rework;

- Difficulty in traceability;

- Wasted time in communication between departments;

- Legal risk due to lack of documentary evidence.

The lack of control weakens the analysis and compromises the agility of credit granting.

Decisions Based on Sales Pressure

Sales team pressure can distort the analysis process.

Phrases like “this client always pays” or “it’s a strategic deal” are common — but dangerous when unfounded.

The credit department exists to protect the company's cash flow, not to meet commercial urgencies without technical analysis.

Concessions outside the criteria lead to default and internal conflicts.

Infographic:

Disregarding Guarantors, Partners, and Business Group

Limiting the analysis to the company requesting credit is a critical mistake.

It is essential to assess the full context:

- The registration and asset situation of the guarantors;

- The history and backing of the partners;

- The related companies within the business group.

Many cases of default could be avoided with a broader analysis that considered overall financial behavior — not just that of the requesting company.

Lack of Guarantees in Risky Operations

It is common to see companies approving significant credit without any formal guarantee.

The lack of surety, contract, or concrete legal bond weakens the company's position in case of default.

Formalizing guarantees is common practice in the financial sector and should be applied in high-risk operations or those outside the standard profile.

Serious businesses protect what they grant.

Lack of Criteria in Exceptional Cases

Atypical cases exist: newly created companies, large orders during seasonal dates, or clients without history but with potential.

The mistake lies in handling these situations based on feelings rather than rules.

The credit policy must define how to handle exceptions: who can approve, based on which criteria, and with what limits.

Without this, occasional decisions become problematic precedents.

Conclusion

Most default losses originate at the source: a poorly executed, disorganized, or emotional credit process.

Avoiding these common mistakes is essential to turning credit granting into a strategic tool.

With a clear policy, a structured system, and a rigorous technical analysis, the company reduces risks, increases financial predictability, and strengthens its sales.