How to Analyze Credit for Corporate Clients (CC)

Assessing a company's credit requires more than documents.

Introduction

Assessing a company's credit risk requires more than documents.

It is necessary to interpret data, understand the context, and make balanced decisions between security and commercial strategy.

In this article, we present the key criteria and practices for conducting an efficient, technical, and structured business credit analysis.

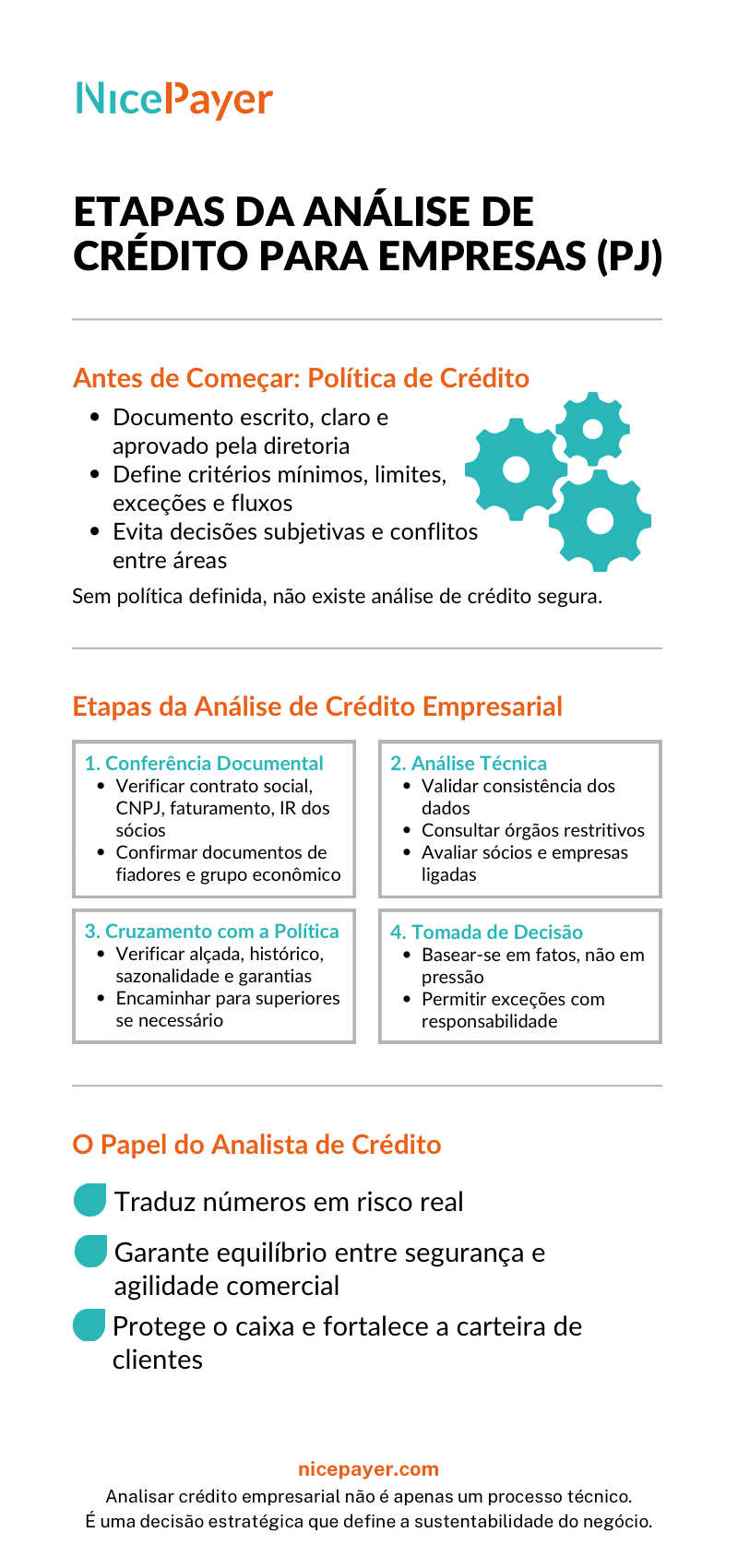

The Foundation: Formalized Credit Policy

Before any individual analysis, the company must have a credit policy that is clear, written, accessible, and approved by management.

This document sets out the rules, limits, approval flows, and minimum criteria for granting credit.

The credit policy must specify:

- The mandatory documentation by client type (corporate, business group, guarantors);

- The proposal flow: who submits, who analyzes, who approves;

- The rules for exceptions, approval limits, and collection criteria.

Without this, each case becomes a subjective decision — opening room for internal conflicts, contradictory decisions, and operational losses.

First Step: Document Verification

The analysis begins with receiving the proposal and the minimum documentation:

- Articles of incorporation, amendments, company registration number;

- Identification and income tax returns of partners and shareholders;

- Proof of revenue;

- Clearance certificates;

- Guarantors’ information (when required);

- Documentation of the business group (if applicable).

At this stage, the registration department performs the initial screening, checking whether the documentation is complete and up to date.

Second Step: Technical Analysis

With the documents in hand, the proposal goes to the credit analyst.

Here, the analysis goes beyond paperwork: it involves strategic reading and interpretation of real risk.

The analyst must:

- Validate the consistency of the information provided;

- Observe warning signs (inconsistent data, low liquidity, indebtedness);

- Check restrictive agencies (credit bureaus, protests, lawsuits);

- Analyze the partners’ behavior in other companies;

- Assess the structure of the business group, when applicable.

An experienced analyst does not look only at what is declared. They read the context and see what lies behind the numbers.

Infographic:

Third Step: Cross-check with Policy

The proposal must be compared against the criteria of the credit policy.

If the requested amount is within the analyst’s approval limit, they can approve. Otherwise, it is forwarded to the supervisor or committee.

At this stage, it is important to consider:

- The client’s history with the company;

- Sales seasonality (Black Friday, year-end, expansion);

- Seller’s evaluation (as long as documented and justified);

- Existence of formal guarantees.

Fourth Step: Responsible Decision Making

The decision must always be based on facts, not on commercial pressure.

In special cases — such as newly established companies with high-net-worth partners — the policy may allow exceptions with higher-level approval.

In high-risk situations, with inconsistencies, legal shields, or lack of guarantees, denial is the most technically correct decision.

The Role of the Credit Analyst

The credit analyst is a strategic professional, not just operational.

They ensure that the company sells safely, without hindering sales, but also without exposing cash flow.

Their role requires:

- Technical knowledge;

- Critical vision;

- Procedural rigor;

- And sensitivity to out-of-the-ordinary cases.

Companies with experienced analysts make better decisions, protect their portfolio, and increase growth capacity.

Conclusion

Analyzing credit for corporate clients requires method, criteria, and intelligence.

It is not enough to gather documents. It is necessary to understand the client, the market, and the risks they represent.

With a clear policy, a well-defined process, and trained analysts, the company turns granted credit into a tool for solid and sustainable growth.