How much does an internal credit department cost

Here we show the main costs and responsibilities.

Introduction

In many companies, the credit granting process is still improvised.

The sales team decides based on trust, or the financial manager takes over, even when already overloaded.

When volume grows or risks increase, the idea of structuring a credit department arises.

But how much does it cost to maintain this structure the right way?

In this article, we show the main costs and responsibilities—so the decision can be technical and informed.

The credit analyst: a technical and essential professional

The credit analyst is the central figure in the process.

They assess risks, interpret data, perform checks, and apply policy criteria.

This professional must have technical knowledge, practical experience, and a responsible approach.

- Average monthly salary of a mid-level credit analyst: R$ 5,750

- With charges and benefits (INSS, FGTS, 13th salary, vacation): about R$ 8,000 per month

If coverage, rotation, or a high volume of proposals is needed, the cost naturally increases.

Credit system: complexity and high cost

To ensure traceability, security, and control, a specific system for credit workflow management is necessary.

Spreadsheets, emails, and messages are not enough for the operation.

Market systems with the right features—workflow, rules, history, security, and document control—are expensive.

In addition to the monthly fee, there are setup, support, and update costs.

Real cost examples:

- Initial setup (one-time payment): R$ 20,000 to R$ 50,000

- Monthly fee with technical support: R$ 3,400 to R$ 4,800/month

- Estimated total monthly with system: R$ 3,400 to R$ 4,800

Infographic:

Credit policy: technical, formal, and costly

Another point many companies ignore is the cost of developing a credit policy.

This document is the technical basis of the entire process: it defines rules, limits, exceptions, flows, and responsibilities.

Creating a robust policy requires:

- Business model diagnosis

- Definition of criteria by segment

- Structuring internal flows

- Formal approval with directors and involved areas

Estimated cost of the credit policy (one-time):

R$ 8,000 to R$ 20,000, depending on the company's size

It is a one-time cost, but essential for the process to work safely and consistently.

Risks and operational losses

In addition to direct costs, there are indirect impacts not shown in the budget:

- Rework due to process failures

- Wasted time with poorly filled proposals

- Delays in approval due to unclear workflow

- Decisions made under pressure, without criteria

- Difficulty in future collections due to lack of formal guarantees

These losses directly affect the company's cash flow and predictability.

Estimated operational impact (monthly): R$ 1,000

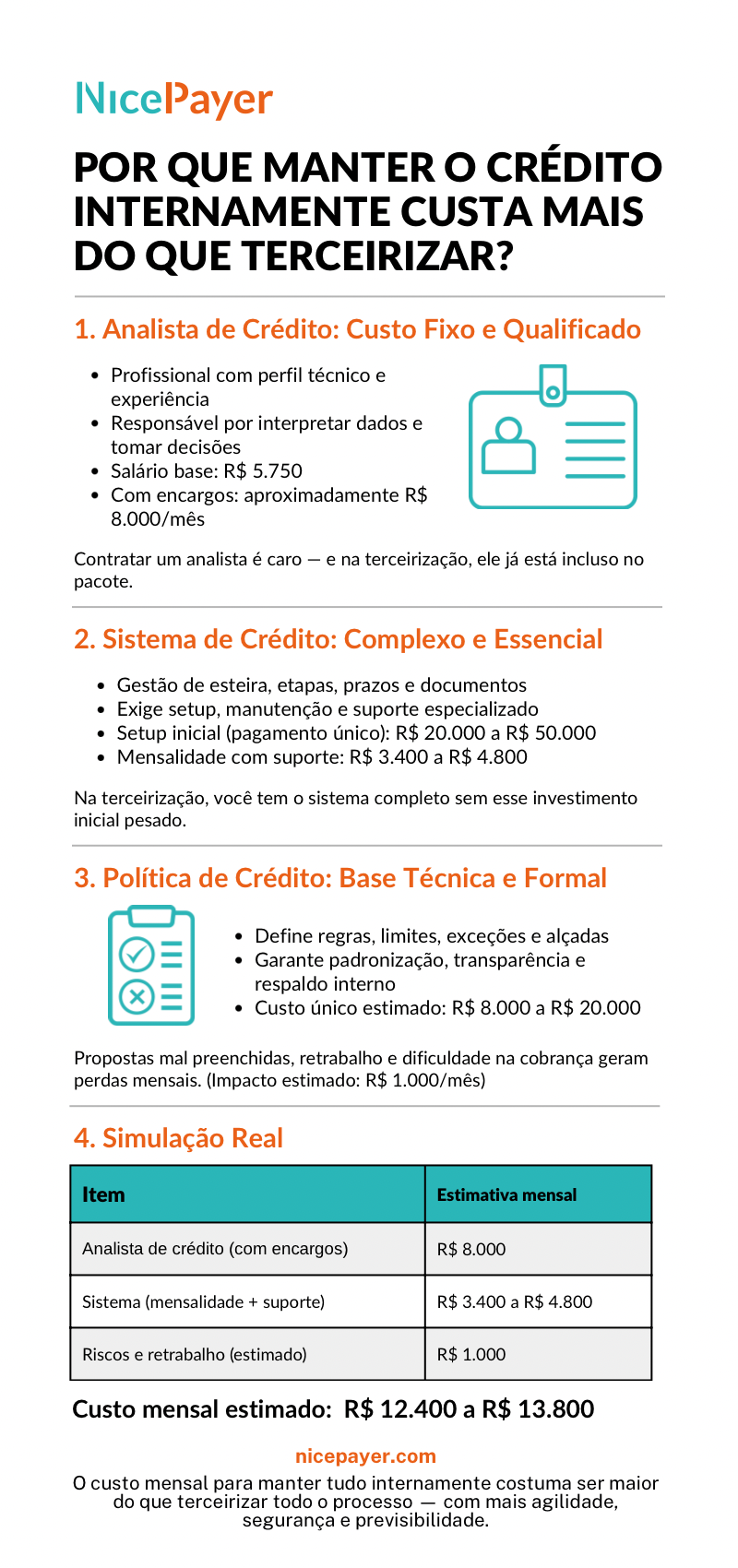

Practical monthly cost simulation

Estimated costs for an internal credit department:

1st Item:

Credit analyst (with charges)

1st Monthly estimate:

R$ 8,000

2nd Item:

Credit system (monthly fee + support)

2nd Monthly estimate:

R$ 3,400 to R$ 4,800

3rd Item:

Rework and operational losses (estimated)

3rd Monthly estimate:

R$ 1,000

Estimated total monthly cost:

R$ 12,400 to R$ 13,800

Additional one-time costs (not included in monthly):

- System setup: R$ 20,000 to R$ 50,000

- Credit policy: R$ 8,000 to R$ 20,000

Conclusion

Maintaining an internal credit process goes beyond hiring an analyst.

It requires investment in technology, structure, and above all, method.

Even organized companies end up underestimating the cost of keeping credit running safely and under control.

This calculation needs to be made coldly:

The monthly cost of keeping everything in-house is usually higher than outsourcing the entire process — with greater agility, security and predictability.

This is the reflection that must be ready before deciding the next step.