Documents Required for Credit Analysis

Granting credit without the minimum documentation compromises security.

Introduction

Granting credit to companies requires a structured process based on solid and documented information.

Granting credit without the minimum required documentation compromises operational security and exposes the business to high default risks.

In this article, we present the documents required for business credit analysis and the essential precautions to protect cash flow.

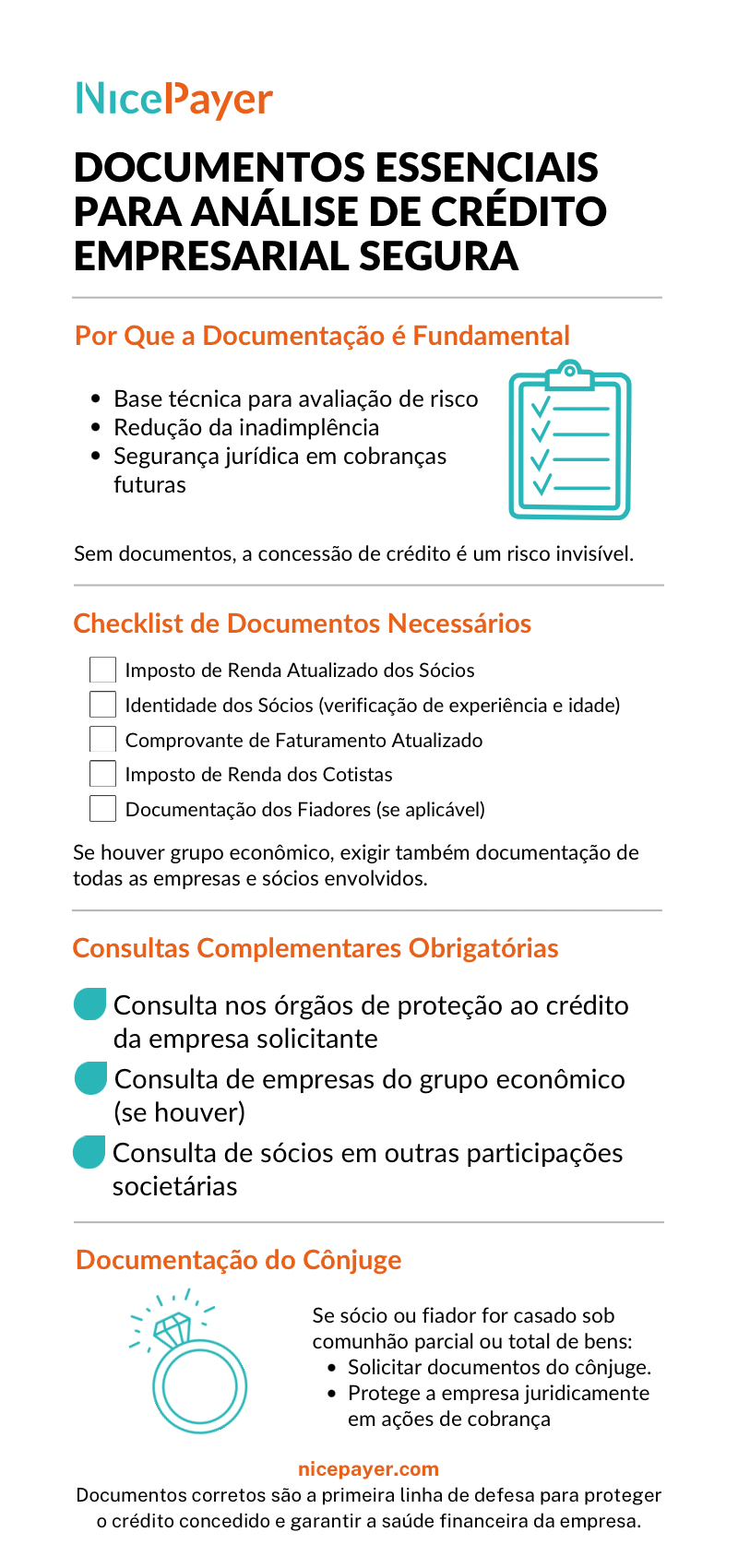

The Importance of Documentation in Credit Analysis

No financial institution grants credit without complete documentation, regardless of the amount requested.

Companies that want to protect their cash flow and structure a responsible credit granting process must adopt the same rigor.

Documentation is not a bureaucratic formality.

It is the technical basis for assessing risks, proving payment capacity, and strengthening the company’s position in future collections.

Checklist of Documents Required for Business Credit Analysis

For proper business credit analysis, the minimum required documentation includes:

- Updated Income Tax Return of Partners

- Partners’ Identification

- Allows verification of authenticity and collection of relevant information such as age and professional experience, which are important for risk assessment.

- Updated Proof of Company Revenue

- Shareholders’ Income Tax Return

- Guarantors’ Documentation (if applicable)

Having the correct documents is essential to support the credit decision and reduce default risk.

The Importance of Consulting Credit Bureaus in Credit Analysis

In addition to formal documentation, it is essential to consult credit protection agencies.

This consultation should consider:

- The requesting company;

- Other companies linked to the business group;

- The partners’ situation in other shareholdings.

This practice ensures that there are no hidden financial liabilities that may affect future payments.

Infographic:

Economic Group Analysis: Documents That Must Be Required

Companies belonging to economic groups require broader document analysis, including:

- Documentation of the group’s companies;

- Documentation of the partners of each company.

This care is even more necessary in cases of common partners or a history of financial restrictions.

Spouse Documentation in Credit Analysis: Why It Is Essential

If the partner or guarantor is married under partial or full community property, the spouse’s documentation must be requested.

The couple’s assets are jointly liable for obligations, making this analysis essential to ensure legal security of the transaction.

The Role of the Document Checklist in the Credit Process

Companies that use a formal checklist ensure:

- Organization of proposal flow;

- Traceability of information;

- Reduction of errors and rework;

- Agility in the granting process.

The checklist must be an integral part of the credit policy, ensuring standardization and technical rigor.

Conclusion

Requiring the necessary documents for credit analysis is the first step toward responsible and secure granting.

Complete documentation, credit bureau consultations, and analysis of the business group protect cash flow, strengthen the client portfolio, and ensure sustainable company growth.